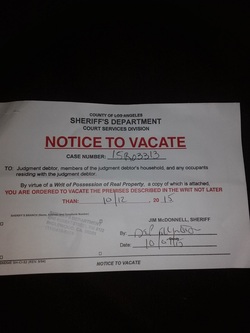

Well, Dear readers, this is something new. Although I have been down eviction road before, it has never gone this far. I've usually been blessed to find another place rather quickly, and pull it all together, and move on. Not this time. Although I am making every effort to get it together, I have to be gone by COB on Monday. Or, first thing Tuesday morning, I lose everything that I haven't moved.

Once you have an eviction on your record, most PMFs will not rent to you under any circumstances. Even if the circumstances that caused the eviction have changed, or you have tamed (sort of) the payday loan beast, an eviction is an eviction, and owners mostly don't want to take that chance anymore. le sigh.

I wish I had never taken out even one of those doggone loans. I feel like not only am I going to be paying for it for the rest of my life, now it's affecting my daughter as well, which is the one thing I was trying to avoid. This has been quite the learning experience. One that I fear is not quite over yet.

This is going to be one long, strange weekend.

ETA: A friend of mine suggested the I do a Go Fund Me to help with my living situation in the meantime. Pride-wise, especially since I have been through this before, AND very recently, at first I rejected the idea. But I swallowed my pride and did it anyway: https://www.gofundme.com/2r62yfjs

Sometimes, I hate my life. Will I ever live down my mistakes? Only time will tell.

RSS Feed

RSS Feed